Understanding Markets & You

CAL Bangladesh is a growing financial intermediary with a solid presence in Bangladesh, offering merchant banking and stock brokerage services to a diverse clientele.

Let your money work

as tirelessly as you do.

900Mn + USD

Assets Under Management by CAL Group

CAL’s Value Proposition

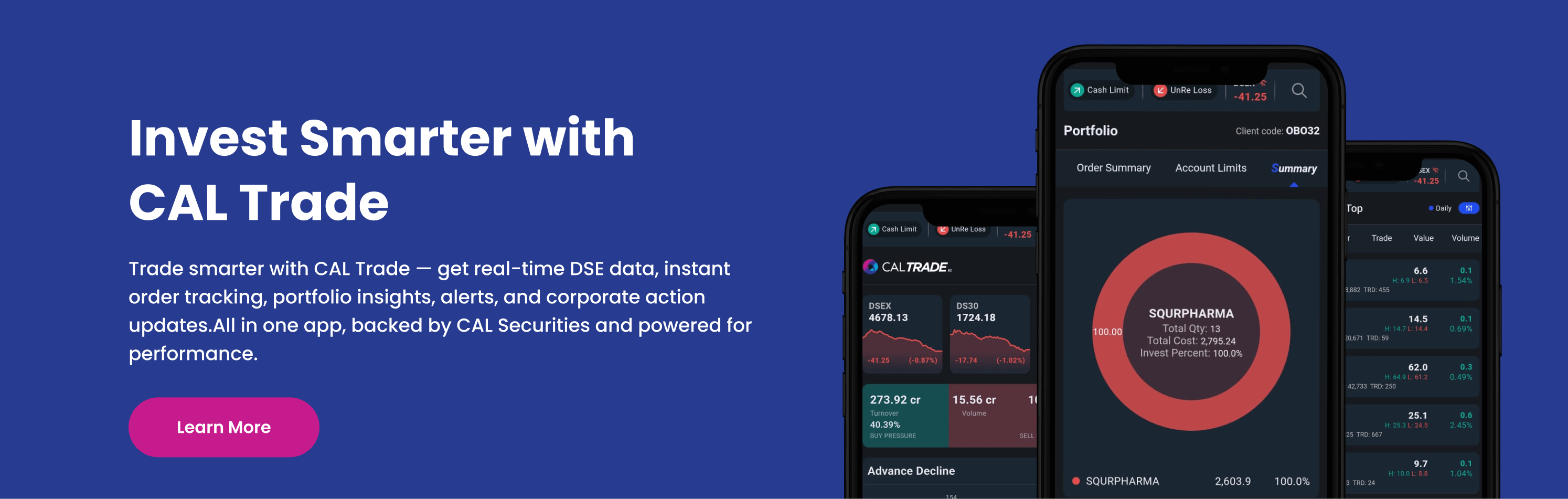

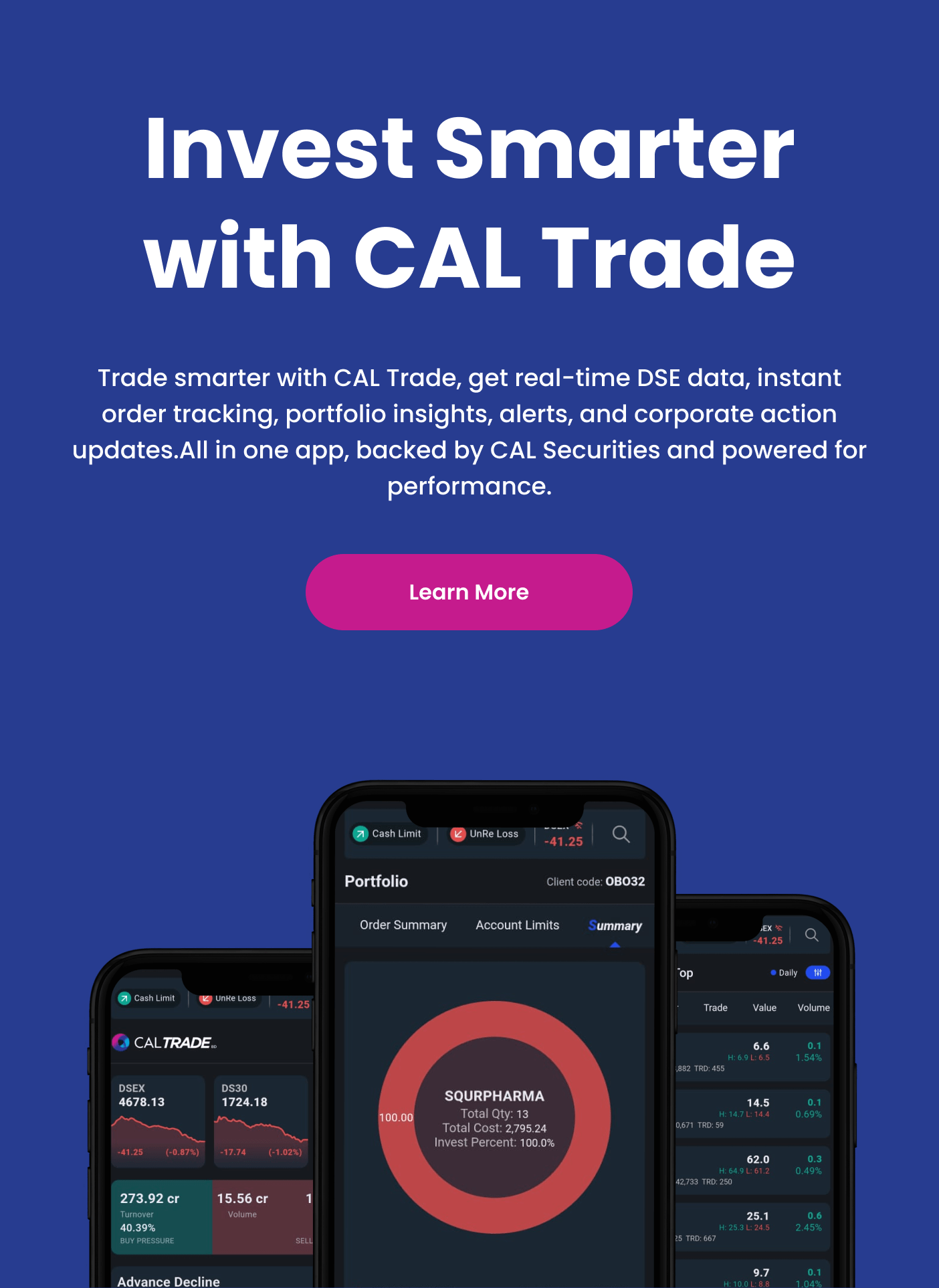

Your preferred partner in financial markets offers one-stop integrated solutions providing timely and relevant insights and technology-enabled innovations.

CAL’s distinct approach

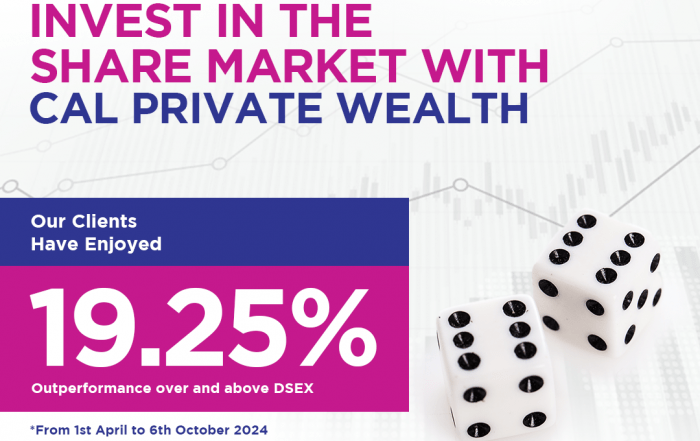

Drawing on our extensive knowledge and insight on each asset class to deliver value to all our clients, whether individual, corporate or institutional.

Establishing enduring relationships with our clients to help navigate evolving financial markets.

Latest News

CAL is a highly-active, dynamic organization with a range of industry updates and events to bring to you periodically